It’s been nearly a decade since the global financial crisis swept through markets across the world. In the United States, President Donald Trump has advocated weakening the rules that were established in the wake of the crisis, while other world leaders warn against turning back. Global Network Perspectives asked experts across the world about the risk of financial instability in their countries and regions.

What are the odds of major financial market disruption in your country? What are the major risks right now? Is your country better prepared to mitigate/manage such risks than it was before the 2008 crisis?

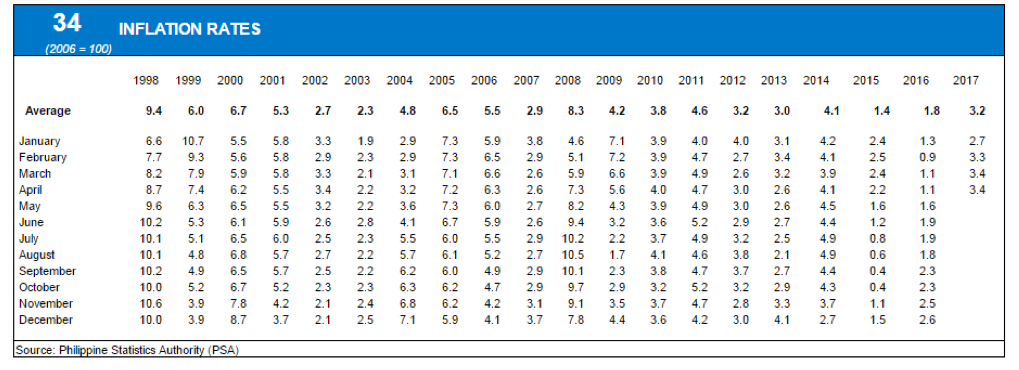

Having a major financial market disruption in the Philippines is less likely to happen because of the stable macroeconomic fundamentals set by Central Bank of the Philippines, including monetary and fiscal policies. For example, the Philippines has managed to maintain its annual inflation rates between the ideal 3-5% margin for the last eight years. This means that the Central Bank has been effective in managing the financial risks and establishing the foundations of the country’s macroeconomy.

Figure 1: Philippine Inflation Rates (1998-2017)

Perhaps, the possible risks to the economy were more political in nature rather than economic. One is a changing of the guard at the Central Bank, which will have new governor by July 2017. However, the coming appointment of Deputy Governor Nestor Espenilla Jr. – a career central banker – as the Central Bank’s Governor may lower the risk of change.

Another is the current administrations’ “war on drugs” and its related human rights abuses that has raised criticism from international organizations. These, together with President Duterte’s colorful language and immoderate comments against these groups and other country/regional partners (e.g. the United States and European Union) could obstruct international investment flows and trade. While this risk will likely remain a major issue, business-to-business relations will continue to be strong due to the country’s good economic fundamentals and high involvement in global value chains.

These risks are indeed different from the 2008 crisis. The Philippines, nonetheless, will remain to be resilient despite the increasing volatility, uncertainty, complexity, and ambiguity of international political economic environment because of OFW (Overseas Filipinos) remittances contributions, which have been robust and has been a major driver of the economy; cautious policy issuances to regulate Financial Technologies (FinTech) by the Central Bank; and the expected implementation of tax reforms which could increase the country’s arsenal for massive infrastructure spending.