Scholars at the University of Ghana Business School pinpoint changes that could improve the liquidity and informational efficiency of the Ghana Stock Exchange as the country faces the economic impact of the COVID-19 global pandemic.

The COVID-19 crisis that originated in Wuhan, China, has spread across the globe and led to the deaths of thousands of people across the world. At the time of writing, more than 4.34 million people had contracted the virus worldwide with more than 297,200 deaths

The slowdown in economic activity, coupled with restrictions placed on movement, both locally and internationally, is definitely having a toll on the production and profitability of companies worldwide. Some companies have come close to bankruptcy. For example, Virgin Australia announced that it had gone into voluntary administration due to the halt in flights and the closure of borders across the world. Many other companies are facing dire financial circumstances, particularly those with inadequate liquidity. A number of companies have come to the stock markets to raise capital to bolster their equity and liquidity positions. Further, to conserve liquidity, a number of companies have decided not to pay dividends. In the banking industry, regulators have advised and, in some cases, instructed banks not to pay dividends. In Australia, the Australian Prudential Regulation Authority (APRA) advised banks in Australia to consider not paying dividends to their shareholders. In Ghana, the Bank of Ghana (BOG) took a stronger position by asking banks not to pay dividend to their shareholders. Given the heightened level of uncertainty, a number of companies have also withdrawn their earnings guidance.

As events unfold each day, the global financial environment remains uncertain, increasing the risk perception of market participants. Some market participants have shifted their investments from equity and private bond markets to the holding of government bonds, cash, and other safe assets such as gold that seem safer under the current circumstance. Indeed, gold prices have skyrocketed, rising from about $1,500 in January to about $1,700 in April (https://www.marketindex.com.au/gold). So far, the outbreak of COVID-19 has had an unprecedented effect on the volatility of several markets. The increased volatility in markets has been picked up by volatility indicators such as the VIX Index (see Figure 1).

Figure 1: VIX Index

The crisis has affected financial markets across the world. Some central banks indicated their willingness or commitment to provide an almost endless supply of money. The governor of the Bank of England, for example, indicated that the bank was willing to print additional money if needed (Sky News, 2020). Central banks have rushed to reduce interest rates and, in some cases, have entered into a negative interest rate territory. In Ghana, the Bank of Ghana reduced its monetary policy rate by 150 basis points. It dropped its benchmark rate from 16% to 14.5% at its last meeting in March 2020. It also reduced the reserve requirements that banks have to hold from 10 to 8%, among other measures (see https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#G). Central banks have also engaged in unconventional monetary policies such as quantitative easing by buying government bonds in the second markets. This has led to an increase in bond prices and a fall in long-term interest rates. This fall in long-term interest rates is expected to make borrowing cheaper for firms, so that investment activity will not be severely affected. The increased investment by firms is then expected to revive the economy.

Further, many governments have also implemented stimulus packages to prevent their economies from sliding into deep recessions. For example, the Trump administration in the United States put in place a stimulus package worth more than $2.7 trillion, which represents more than 11% of GDP (https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#U). In Australia, stimulus packages covering both expenditure and revenue measures amount to about A$194 billion, representing about 9.9% of GDP (https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#A). In Ghana, the government has set aside GHc$10.6 billion under the Coronavirus Alleviation Programme to support sectors such as the pharmaceutical industry and small businesses (https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#G).

Major stock markets across the world have experienced severe declines due to the pandemic. For example, the S&P 500 experienced a loss of 13.10% in March 2020. The S&P 200 in Australia, the FTSE 100 in the U.K, the Nikkei 225 in Japan, the DAX in Germany, the SSE in China, and the CAC 40 in France experienced declines of 21.15%, 14.77%, 9.27%, 17.41%, 5.14%, and 18.83%, respectively, in March 2020. In West Africa, the Ghana Stock Exchange (GSE), the BVRM for the French speaking West African nations, and the Nigeria Stock Exchange (NSE) experienced declines of 2.36%, 9.77%, and 17.49% in March 2020 respectively. Thus, the GSE experienced the lowest decline. This was despite the fact that cases in Ghana outweighed those in Cote D’Ivoire in absolute terms and were similar to that in Nigeria in absolute terms. The cases in Ghana, however, far outweigh those in Nigeria in relative terms, given that Nigeria has a larger population compared to Ghana.

Unlike most stock markets across the world, the Ghana Stock Exchange did not experience much volatility. The standard deviation of market returns based on our calculations was only 0.76% between January and April 2020. The GSE seems to be artificially calm compared to the heightened volatility experienced across the major markets. This artificial calm has implications for risk management of financial institutions such as the banks listed on the GSE. Low trading volumes and little movements in the stock prices of these institutions mean that standard deviations, correlations, value at risk (VaR) and expected shortfall (ES) measures will be artificially low. Further, the illiquidity of the market implies that investors would not want to invest in initial public offers (IPOs). This will prevent new firms from listing on the market. Trading and liquidity contribute to market efficiency as has been shown by previous studies (see Chung and Hrazdil, 2010).

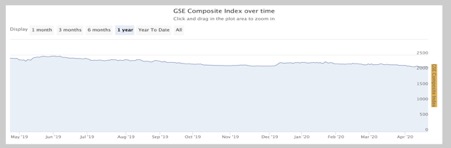

The GSE never entered into bear territory (a loss of more than 20%) between January and March 2020. Our calculations show that the cumulative daily losses in January, February and March were -1.81%, -0.12%, and -2.34%, respectively. The largest single day decline in the index between January and March was -1.11%. The largest single day gain in the index during the same period was 1.93%. Appendix 1 shows that the GSE Composite index fell by 1.91%, 0.01%, and 2.36% in January, February, and March, respectively. This compares to a return of -0.59%, -8.70%, and -13.10% for the SP 500 in January, February, and March, respectively. Figure 1.1 provides the trend in the GSE Composite Index between May 2019 and April 2020.

Figure 2: Movement in the Ghana Stock Exchange (May 2019 – April 2020)

In addition, very few trades took place on the GSE between January and March 2020. Specifically, the total volume traded in January, February and March were 53.9 million, 28.7 million and 14.1 million. Interestingly, while trading activity heightened across the world, the opposite was observed on the GSE. Trading activity actually declined over the period. Could it be that the GSE is providing an indication that COVID-19 in Ghana is not as serious as COVID-19 in other countries? The analysis above suggests that this is not the case. Further, assuming that the Ghanaian stock market is efficient, this observation may not be entirely correct as the level of activity observed on the market has been low.

The announcement by the Ghanaian president of fiscal measures and social distancing measures (March 16, 2020) to reduce the impact of the virus should have reflected on the market, unless the market believed that the measures were insufficient in which case the market should have probably declined. On this day, there was no change in the market index. Further, the announcement of monetary policy measures (March 18, 2020) such as the decline in the policy rate and reductions in the reserve requirement amongst others should probably have led to an increase in the market index. On the contrary, the market declined on this day. Further, the closure of the Ghanaian borders on the March 23, 2020 is another key event that ordinarily will reflect in stock market activity. The data shows that there was no change in the market index on this day. Finally, stock markets have begun to rise and look beyond the bad economic data being reported in anticipation that lockdown measures will substantially be eased across the world. In Ghana, the President announced the lifting of partial lockdown measures on April 23, 2020. The market rose by about 2.69% on this day. On the whole, it seems that the GSE did not respond to key measures announced during this crisis period. The current analysis, if anything, suggests that there has not been much improvement in the efficiency of the GSE. Indeed, a number of previous studies have shown that the GSE is not efficient (Awiagah and Choi, 2018; Ayentimi and Naa-Idar, 2013; Ntim et al., 2007; Osei, 2002). Figure 3 shows the daily returns on the GSE between January and May 2020.

Figure 3: Daily GSE Returns

So, what can be done to make the GSE more efficient? We believe that pension funds have a big role to play in improving the informational efficiency of the stock market in Ghana. Pension funds are custodians of long-term capital and can afford to invest in long-term assets such as stocks given the long-term nature of their liabilities. Unfortunately, it appears that most pension funds invested primarily in short-term money market instruments over the last few years given the high yields (Ghana Business Development Review, 2016). Fortunately, given that interest rates are generally coming down and that there has been a trend toward disinflation, we hope that this provides sufficient incentives for pension funds to rebalance their portfolios towards the capital markets. This should improve the liquidity and informational efficiency of the Ghana Stock Exchange. Further, it will encourage more companies to list on the market to raise capital. We believe that this would lead to further growth and development of the Ghanaian economy as has been shown by the finance and growth literature (see for example Beck et al., 2015; Beck and Levine, 2004; King and Levine, 1993; McKinnon, 1973; Schumpeter, 1912).

References

Awiagah, R., & Choi, S. S. B. (2018). Predictable or Random?-A Test of the Weak-Form Efficient Market Hypothesis on the Ghana Stock Exchange. Journal of Finance and Economics, 6(6), 213-222.

Ayentimi, D. T., Mensah, A. E., & Naa-Idar, F. (2013). Stock market efficiency of Ghana stock exchange: An objective analysis. International Journal of Management, Economics and Social Sciences, 2(2), 54-75.

Bank of Ghana. (2020, March 18). NOTICE NO. BG/GOV/SEC/2020/01: Guidance on the Utilisation of Capital and Liquidity Releases to Banks And SDIs. Retrieved from Bank of Ghana: https://www.bog.gov.gh/wp-content/uploads/2020/03/Notice-No-BG-GOV-SEC-2020-01-Guidance-on-the-Utilisation-of-Capital-and-Liquidity-Releases-to-Banks-and-SDIs-1.pdf

Beck, T. and Levine, R. (2004). Stock markets, banks, and growth: Panel evidence. Journal of Banking and Finance, 28(3):423–442

Beck, T., Lu, L., and Yang, R. (2015). Finance and growth for microenterprises: Evidence from rural china. World Development, 67:38–56.

Chung, D., & Hrazdil, K. (2010). Liquidity and market efficiency: A large sample study. Journal of Banking & Finance, 34(10), 2346-2357.

Ghana Business Development Review. (2016). Ghana Business Development Review. Legon: University of Ghana Business School.

King, R. G., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The quarterly journal of economics, 108(3), 717-737.

McKinnon, R. I. (1973). Money and Capital in Economic Development (Washington: Brookings Institute).

Ntim, C. G., Opong, K. K., & Danbolt, J. (2007). An emperical re-examination of the weak form efficient markets hypothesis of the Ghana Stock Market using variance-ratios tests. African Finance Journal, 9(2), 1-25.

Osei, K. A. (2002). Asset pricing and information efficiency of the Ghana Stock Market. AERC.

Schumpeter, J. A. (1912). 1934. The theory of economic development.

Sky News. (2020, March 18). Coronavirus: 'Radical' money printing plan being considered by the Bank of England. Retrieved from Sky News: https://news.sky.com/story/coronavirus-boe-could-take-radical-money-printing-action-11959670

World Health Organization. (2020, May 5). Coronavirus disease (COVID-19) outbreak situation. Retrieved from World Health Organization: https://covid19.who.int/

Appendices

Appendix 1: Selected Markets Across the World

|

Market |

JANUARY |

FEBRUARY |

MARCH |

|||

|

|

Change in Market Index (%) |

Change in Market Capitalization ($) |

Change in Market Index (%) |

Change in Market Capitalization ($) |

Change in Market Index (%) |

Change in Market Capitalization ($) |

|

SP 500 – U.S |

-0.59% |

-0.04T |

-8.70% |

-2.25T |

-13.10% |

-3.05T |

|

DJIA – US |

-1.34% |

|

-10.28% |

|

-14.35% |

|

|

NASDAQ – US |

1.23% |

347.51 B |

-6.78% |

-887.54 B |

-11.16% |

-1.38 T |

|

SP 200 – Australia |

4.98% |

38.92 B |

-8.21% |

-120.5 |

-21.15% |

-278.016 B |

|

FTSE 100 – UK |

-4.19% |

-101.50 B |

-10.18% |

-279.90 B |

-14.77% |

-412.85 B |

|

NIKKEI 225 – JAPAN |

-0.49% |

-156.93 B |

-7.57% |

-717.15 B |

-9.27% |

-330.11 B |

|

Hang Seng – Hong Kong |

-6.86% |

-274.44 B |

-0.23% |

-25.95 B |

-9.49% |

-369.38 B |

|

Kospi – South Korea |

-3.73% |

-39.82 B |

-4.77% |

-72.75 B |

-12.14% |

-612.38 B |

|

DAX – Germany |

-1.90% |

-40.34 B |

-8.77% |

-159.65 B |

-17.41% |

-275.11 B |

|

CAC 40 – France |

-3.49% |

-71.70 B |

-8.80% |

-207.30 B |

-18.83% |

-381.57 B |

|

SSE -Shanghai Composite Index (China) |

-2.93%

|

-121.13 B |

6.02%

|

-158.37 B |

-5.14%

|

-213.99 B |

|

JSE – South Africa |

-2.99%

|

-16.87B |

-10.89%

|

-105.40B |

0.46%

|

-111.97B |

|

BVRM – French Speaking West Africa |

-2.98%

|

|

-4.01%

|

|

-9.77%

|

|

|

NSE - Nigerian Stock Exchange |

7.35% |

5.8 B

|

-8.12% |

-5.9T

|

-17.49% |

-12 B

|

|

GSE - Ghana Stock Exchange |

-1.99%

|

-$7.8 million |

-0.01%

|

-$32 million |

-2.36%

|

-$50.7 million |

Sources: Yahoo Finance; jse.co.za; nse.com.ng